EU Investors will keep a close eye on upcoming Eurozone data.

Credit: Currencies Direct

Euro

EUR/GBP: Unchanged at £0.83

EUR/USD: Down from $1.11 to $1.08

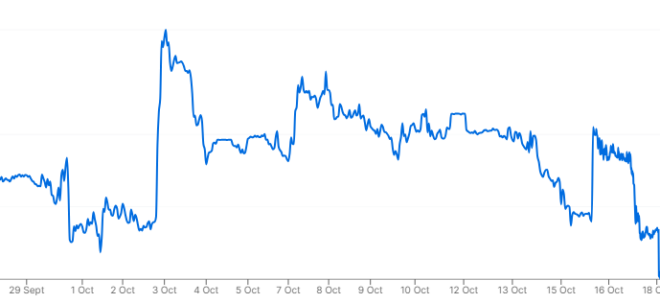

The euro closed September on a sour note, as EUR investors were spooked by abysmal Eurozone PMI figures.

As we entered October, these losses were compounded by a weaker-than-expected Eurozone inflation print and several dovish remarks from European Central Bank (ECB) policymakers.

EUR exchange rates then plunged to new multi-month lows in the wake of the ECB’s interest rate decision in the second half of October. In addition to cutting rates, the bank hinted that it will continue to loosen its monetary policy in the coming months.

Looking ahead, EUR investors will keep a close eye on upcoming Eurozone data, with a particular focus on the bloc’s third quarter GDP release.

Pound

GBP/EUR: Up from €1.19 to €1.20

GBP/USD: Down from $1.33 to $1.30

The pound was buoyant through the end of September, as it was underpinned by upbeat PMI figures and comments from Bank of England (BoE) Governor Andrew Bailey suggesting that UK interest rates will fall ‘gradually’.

However, Bailey appeared to do a 180 at the start of October, with his remarks suggesting the bank may become a ‘bit more aggressive’ in cutting rates, triggering a sharp plunge in GBP exchange rates.

Subsequent movement in the pound was uneven, with mixed UK economic data and uncertainty over Chancellor Rachel Reeves’s impending Autumn Budget infusing volatility into Sterling.

The immediate focus for GBP investors will undoubtedly be the budget announcement on 30 October. The Chancellor will need to avoid spooking markets with her spending and tax plans or the pound is likely to weaken.

US Dollar

USD/GBP: Up from £0.75 to £0.76

USD/EUR: Up from €0.89 to €0.92

The US dollar has enjoyed a notable recovery over the past month as USD investors reined in their expectations for additional rate cuts from the Federal Reserve.

Bets for another bumper rate cut in November quickly evaporated in response to upbeat US economic data and hawkish remarks from Fed Chair Jerome Powell.

These gains were further reinforced by a negative shift in market risk appetite.

As we enter November, the US Presidential election looms large. The election itself remains too close to call, and this uncertainty could infuse volatility into the US dollar in the coming weeks.

Currencies Direct have helped over 430,000 customers save on their currency transfers since 1996. Just pop into your local Currencies Direct branch or give us a call to find out more about how you can save money on your currency transfers.

Costa News Spain Breaking News | English News in Spain.

Costa News Spain Breaking News | English News in Spain.