Friday, 7th of March 2025 13:55

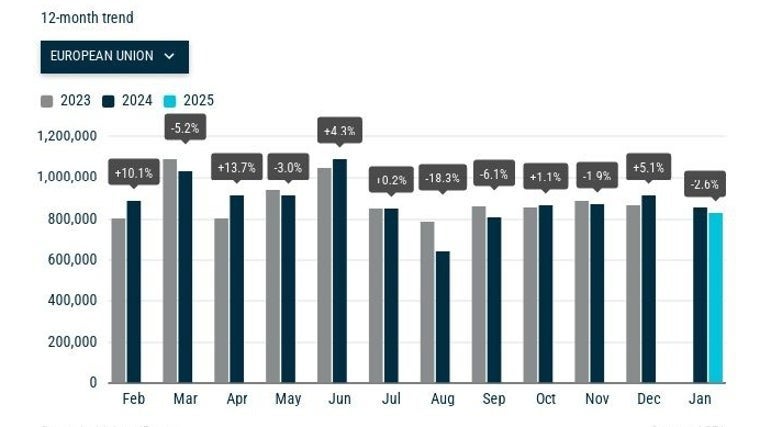

The EU’s new registrations of cars fell by 2.6% in January 2025. This includes the EU’s major markets, France (-6.2%), Italy (-5.8%), Germany (-2.8%). Spain, on the other hand, saw a 5.3% increase.

According to data released by the European Automobile Manufacturers Association (Acea), passenger cars and SUVs were registered in Europe in 831,201 in January. This is 2.6% less than the 853,249 units registered in January 2024.

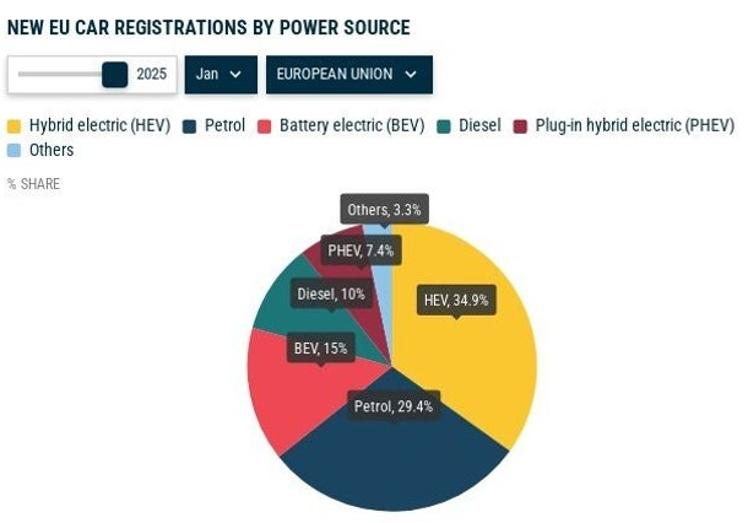

Battery electric vehicles now represent 15% of the total market, compared to the 10.9% share in January 2024. Hybrid-electric cars dominated the market with almost 34.9%, and remain the most popular choice among EU buyers. In January 2025 the combined market shares of petrol and Diesel cars will fall to 39.4%, from 48.7%.

The sales of new plug in electric cars increased by 34%. This represents a 15% share of the market. Three of the four biggest markets in the EU, which account for 64% all battery electric cars registered, have seen double-digit growth: Germany (+53.5%), Belgium (+13.72%) and The Netherlands (+28.2%), whereas France has experienced a small decrease of 0.5%.

Registrations in Europe over the past 12 months

ACEA

Sales of hybrid-electric vehicles increased by 18.4%. This was largely due to the growth on four major markets: France (+52.2%), Spain (+23.5%), Germany (+13.7%) and Italy (+10.6%). The EU will have registered 290 014 cars by January 2025. This represents 34.9%.

Plug-in hybrids have declined by 8.5%. This is primarily due to major reductions on key markets like Belgium (-66.6%) or France (-54%). Plug-in hybrids now represent 7.4% of all car sales in Europe.

Cars powered by petrol and diesel

Petrol vehicle registrations have fallen by 18.9% on all major markets. France saw the biggest drop in registrations, falling 28.2%. Germany (-23.7%), Italy (17%), and Spain (-11.1%) followed.

Percentage of registrations according to technology

ACEA

In January 2025, petrol vehicles’ market share fell from 35.4% to 29.4%. Diesel cars also saw a 27% decline in the market, which resulted in a 10% share of the diesel vehicle market. In general, most EU markets saw double-digit declines.

Brands and models

Volkswagen Group (owners of Volkswagen, Skoda Audi Cupra Seat Porsche and others), has begun the year as the manufacturer who has registered the most vehicles in the EU market.

Next in line is the Stellantis Group with 162,506 units registered, a 17.9% drop from the previous year. And finally, the Renault Group has registered 90,362 vehicles, a 5% increase.

Volkswagen was the brand with the most sales on the European market, with 95.975 units. This represents a 14.9% increase. Next, Japanese Toyota followed with 65.794 units (-7.8%), and Skoda with 52.549 units.

Tesla registrations fell by 50%, despite the fact that electric vehicle sales increased by 34% in Europe.

Costa News Spain Breaking News | English News in Spain.

Costa News Spain Breaking News | English News in Spain.